25+ accounts receivable process flow chart

It excludes loan receivables and some receivables from related parties. Here we describe the accounts receivable procedure while the vendor down payment process tutorial concerns accounts payable activities.

News

Enter the relevant chart of accounts in the resulting pop-up screen and hit Enter.

. 25 Accounts Payable Process PR. An accounts payable reconciliation is the comparison of the general ledger account balance and the total of the subledger the identification of differences and the processing of adjustments. Accounts Receivable 100 Total Assets.

For that year we add the beginning and ending accounts payable amounts and divide them by two. Accounts Receivable Days Accounts Receivable Revenue x 365. Many of these things will raise your profit margin.

28 Balance Sheet Statement Preparation Checklist PR. The control accounts are all balance sheet accounts representing liabilities for the amounts deducted from the payroll. 30 Annual Financial Report Template PR.

Then you can use the accounts receivable days formula to work out your total as follows. The employee tax control represents the amount due to the tax authority the net pay control represents the amount due to the employee and finally the other deductions control is. The gross wage is the expense charged to the income statement.

29 Business Tax Preparation Checklist PR. Click the Process down pmnts button to see the advance payments. 26 Income Profit and Loss Statement Process PR.

Graphs are the subset of the charts as the charts are the larger version of the same. This chart of accounts is suitable for use with US GAAP. To fix your cash flow you need more money coming into your business increase sales collect past-due accounts receivable less money going out of your business reduce costs of goods and labor and less money tied up in your business reduce inventory and leased equipment.

Accrual accounting uses invoice processing to both procure and offer services on a credit basis rather than requiring payment. To get the average accounts payable for XYZ Inc. Maintain Special GL Initial Screen.

Exhibit 5191-3 ACS Call Flow IPU 19U1021 issued 09-09-2019. Exhibit 5191-3 ACS Call Flow IPU 19U0039 issued 01-07-2019. This percentage represents all claims against debtors arising from the sale of goods and services and any other miscellaneous claims with respect to non-trade transaction.

The following information will provide an overview of the Collection Process for Delinquent Taxes. A listing of each account a company owns along with the account type and account balance shown in the order the accounts appear in the companys financial statements. Chart Of Accounts.

To calculate the accounts payable turnover ratio we then divide total supplier purchases 48000 by average accounts payable 2900. In contrast the chart as stated earlier is a type of graphical representation of the information or the data in which the data that is represented by the symbols like the lines in a line chart bars in the bar chart or the slices in a pie chart. Penalty charges can range from 25 to 500 of the tax due depending on the type of the tax.

Lets look at an example to see how this works in practice. If you have been contacted by the Michigan Accounts Receivable Collection System MARCS please contact them directly for more information about. Removed hyperlink to Telephone Transfer Guide from paragraph 3 in first row of table and replaced with hyperlink to IRM 51913 Referrals and Redirect.

Flowchart for Month-End Close Process. 27 Cash Flow Report PR. Imagine Company A has a total of 120000 in their accounts receivable along with an annual revenue of 800000.

48000 2900 1655. In contrast IFRS 1531 ASC 606-10-25-23 state. 24 Accounts Receivable Process PR.

An entity shall recognize revenue when or as the entity satisfies a performance obligation by transferring a promised good or service ie. The exact steps in the month-end close process may vary from company to company depending on the type of accounts and transactions that make up its financial data. Updated Example tax years throughout.

Including a monthly closing process in your regular accounting procedures ensures that your numbers are reliable stable and accurate. Expense Management Process PR. Accounts payable only applies to businesses that use the accrual basis of accounting not cash-based accountingThis is because the accrual method of accounting records income and expenses when they are invoiced and paid.

An asset to a customer.

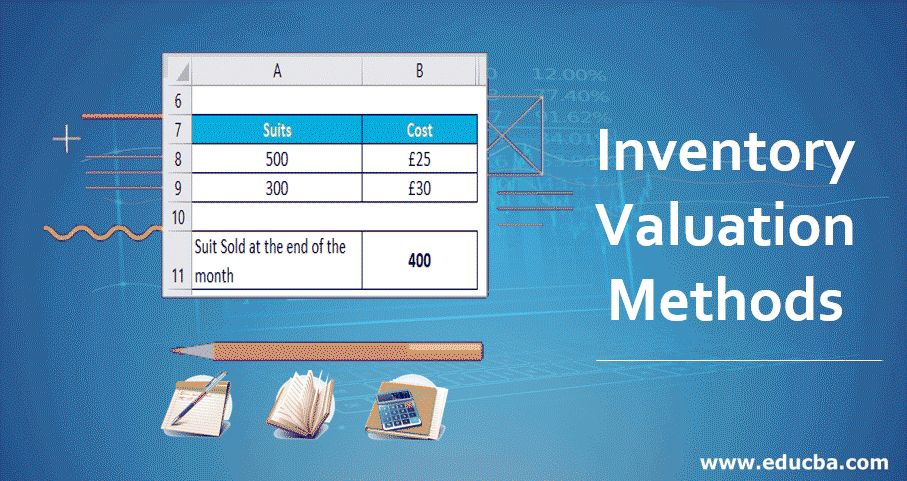

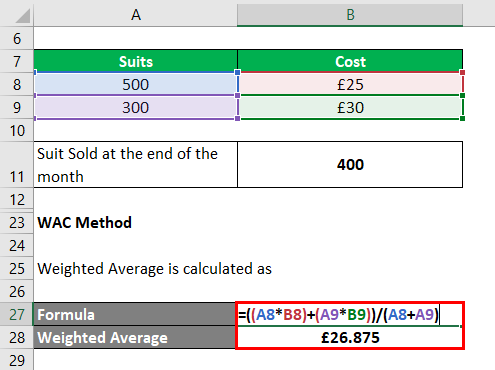

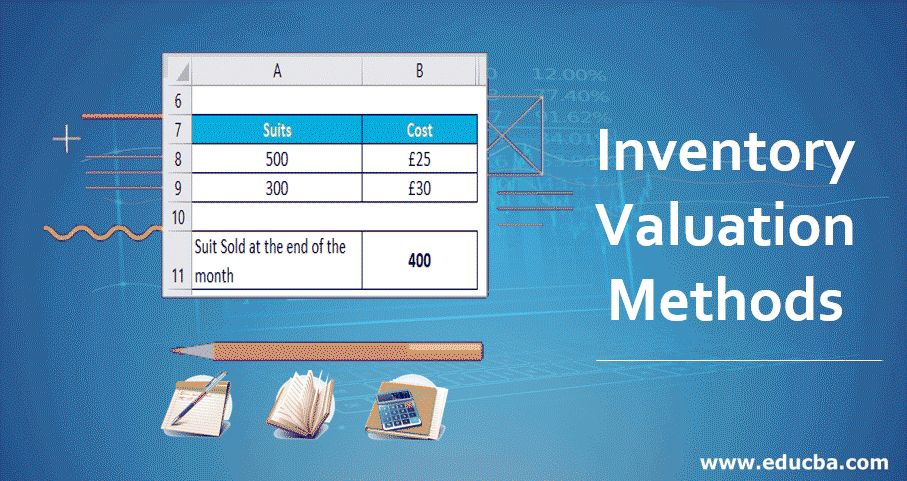

Inventory Valuation Methods Types Advantages And Disadvantages

Brhc10038267 425slide25 Jpg

Sec Filing Jpmorgan Chase Co

Bookkeeper Cv Examples And 25 Writing Tips

Granahan Mccourt Acquisition Corp 2008 8 K Current Report

What Is A Unicorn Company The Top 25 Unicorns Business Models For 2022 Fourweekmba

Investorpresentation

25 Kpis And Metrics For Finance Departments In 2021 Insightsoftware

Sunlight Financial Holdings Inc Ipo Investment Prospectus S 1 A

Amerisourcebergen Analyst Meeting Slides

Inventory Valuation Methods Types Advantages And Disadvantages

Bank Statement Template 25 Free Word Pdf Document Throughout Blank Bank Statement Template Download In 2022 Statement Template Bank Statement Word Template

20 Free Balance Sheet Templates In Ms Excel And Ms Word Besty Templates Balance Sheet Balance Sheet Template Balance

Slide 25 Jpg

Testing Weekly Status Report Template Professional Sample Project Status Report Sazak Mouldings Project Status Report Progress Report Template Report Template

25 Free Editable Organizational Chart Templates Besty Templates Organizational Chart Chart Organizational

425